Gonna Fly Now

It has been hard to sit through 2020 without writing a single piece related to the upcoming Presidential election. Politics are so polarizing, I thought it would be best to steer clear and focus on other topics.

This has become increasingly difficult over the past few weeks after receiving many questions from clients, some of whom are convinced the world might end depending on the outcome of this election.

Similar to Rocky Balboa (thus the theme song reference of Gonna Fly Now), I can no longer resist getting into the ring. I finally gave up and put some thoughts to paper (or computer keyboard).

To be fair, the “world might end” narrative is pervasive on both sides of the political spectrum, fueled by social media and the things both parties say. I think they are equal-opportunity offenders.

What does this all mean for investors?

I want to share a quote from Graham Holloway, former President of American Funds Distributors, in the May issue of Financial Planner magazine:

“In my 25 years in the mutual fund business, I have never known a good time to invest. There are always a dozen good reasons why it makes sense to wait. Today is no exception; interest rates, the President, a cartel that’s controlling the price of energy worldwide, constant strife in the Middle East, excessive government regulations, oppressive tax rates and a Congress that is more a part of the problem than part of the solution. No sane person would invest under those circumstances – unless he wanted to take advantage of an opportunity. I have found over the years that market bottoms occur when there are a great many problems and questions for which there are no solutions or answers. Market tops usually occur when there are no problems to be solved or questions to be answered.”

Sounds timely doesn’t it? It was the May issue, but May of 1981. Almost 40 years ago.

The characters in our story might change every few years, but the plot remains the same. Citizens and investors have always faced challenges, but long-term investors have been rewarded.

The two most popular questions I have received from clients concern the risks associated with a Democrat sweep, a blue wave, and the risks associated with a contested election that extends the uncertainty into late November or December.

Before providing my thoughts, let me stress that there is no answer that can be provided with absolute certainty. Rarely will we find a definitive relationship between political variables and stock market performance. Something else always comes up (such as a global pandemic).

Historically, the state of the economy and the health of the stock market tends to have more of an impact on the outcome of an election, as compared to the impact the election has on the economy and markets.

A Blue Wave

A Democrat sweep should bring about significant policy changes related to income and estate taxes, business regulation, health care, and China relations. In speaking with clients, their primary concern is with tax policy. While higher taxes can be a concern for the markets, a Democrat sweep would most likely provide just a slight majority in the Senate. The current filibuster rules could potentially prevent any meaningful change to tax policy. If tax increases do pass, policies that get enacted are often watered-down from what politicians might campaign on.

While tax increases could be a potential negative for the market, additional initiatives in the clean energy space could be a positive for certain sectors.

It is important to note that even with the “red wave” in the 2016 election, President Trump did not get his tax cuts through until the end of 2017, effective for 2018. It is unlikely that a “blue wave” would result in higher taxes before 2022.

A Contested Election

With the number of absentee ballots expected this year, there is a chance we will not know who the winner is on election night. We might have a pretty good idea, but it won’t be a certainty, especially if neither candidate concedes.

Some of the doomsday scenarios related to a contested election seem a bit overblown. There may be a fight, and a lot of uncertainty, but we have been through this before. The 2000 race between Bush and Gore wasn’t decided until December 12th, but that was still more than a month in advance of the inauguration date.

If it looks like we will not know the winner for several weeks, as opposed to several days, I would expect the markets will sell off, and then recoup those declines once the winner is declared and the uncertainty goes away.

Recent Market Moves

So why have the markets moved higher in recent weeks?

As candidate Biden has surged in recent polls, the likelihood of a close election has been reduced. The race could certainly tighten in the coming weeks, and if 2020 has shown us anything thus far, it is that anything can happen. That said, widening polls reduces the odds of a contested election.

The markets have also moved higher on hopes for a richer stimulus package. As I type this, both Republicans and Democrats are far apart in the negotiations, and it is looking less likely that we will get a bill before election day. If there is a Democrat sweep, the next stimulus bill passed will probably be more robust, which would benefit the economy and stock market in the short-run. There will be concerns about the long-term implications of increased deficit spending, but the stock market will not care for 2021. That is a problem for a decade down-the-road. I am not saying I agree with “spend now and worry about it later”, but the stock market will welcome increased stimulus in the short-run.

If a Democrat sweep means more stimulus dollars coming for 2021, and higher taxes probably not being effective until 2022, the stock market may continue to cheer that news.

Market History

Someone asked me the other week if the stock market liked Republican or Democrat Presidents better. I asked Charles Schwab for assistance with that research, and the answer might surprise you.

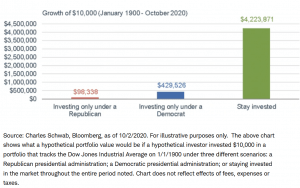

Going back to 1900, if you invested $10,000 in the Dow Jones Industrial Average, but only remained invested during Republican presidential administrations, your $10,000 would have grown to $98,338. If you only invested during Democrat presidential administrations, your $10,000 would have grown to $429,526.

Before you change your investment philosophy to only invest under Democrats, look at the green column. An investor who remained invested no matter what party was in control saw their $10,000 investment grow to over $4.2 million. The US economy has always been resilient.

What comes next?

I read the same polls that you do. I have no idea what the outcome of the election will be, nor the stock market reaction as a result. I do know that our country has been through similar times of great stress in the past, and we have always made it through to the other side.

We continue to own diversified portfolios with enough cash, bonds, and lower-volatility investments to withstand market stress as it occurs.

About the author

William B. Burns, Jr. CFP® is a CERTIFIED FINANCIAL PLANNER professional and President of Burns Matteson Capital Management, a Financial Planning and Investment Advisory Firm with clients throughout the United States. He helps high-net-worth families reduce the worry and anxiety sometimes associated with wealth, allowing families to reclaim that time to reinvest back into their family, social, and professional relationships. www.BurnsMatteson.com

Kelley Zimmerman, FPQP™

Kelley Zimmerman, FPQP™ Eric Sweet

Eric Sweet Christopher Davis, CFP®

Christopher Davis, CFP® William B. Burns JR., CLU, ChFC, REBC, CFP®

William B. Burns JR., CLU, ChFC, REBC, CFP® William F. Redder

William F. Redder Nathan R. Burns, MBA

Nathan R. Burns, MBA